In its annual 2021 report, the International Energy Agency, predicted that the growing trend of global energy demand will gradually continue until 2035, experiencing about 37% growth compared to previous years. This is an expected trend due to the increase in the population size, economic activities as well as the expansion of the global economy. This report also points to the “decreased sensitivity of global markets to the energy factor” and the main reason for the decrement is related to the increased security of the energy supply chain because of investment by developed countries in the renewable energy sector. The volume of energy demand will vary in different regions and for areas such as Europe, North America, Japan and Korea, such demand will to a large extent stabilize. But this trend will see a significant gain in others, especially the developing Asian, African, Middle Eastern and Latin American nations. Among these, Asian countries will account for the largest volume, which may be close to 60% of the demand.

What will the share of fossil fuels be from this increase in demand?

The “Global Energy Perspective 2022” report by McKinsey & Company states that the global demand for fossil fuels will reach its peak in the next 5 years. The introduction states: “We publish this long-term energy outlook at a time when global energy markets are facing unprecedented uncertainty. The global energy landscape has been impacted by increased market uncertainty due to the conflict in Ukraine.”

Before the conflict in Eastern Europe began, the trend of energy demand was relatively stable and investment in renewable energy experienced steady growth. But the onset of the war in Ukraine and Russia’s total energy sanctions created an unprecedented shock to global markets. During the crisis, it became clear that the world’s dependence on fossil fuels was far greater than previously thought. Europe faced a major problem with its energy supply and an alternative to fossil fuels would not materialize in the short-term. But despite the sharp increase in demand for oil and gas, it appears that in the medium and especially long term, investments in renewable energies and the move towards alternative resources will be pursued at an accelerated rate. To understand this we must understand several existing issues.

The first is related to the excessive increase in the price of oil and gas and the increased pressure on the European and East Asian economies. European countries, most of which do not possess oil and gas resources, will face major challenges in order to provide for their energy demands, if oil and gas continue to dominate the world markets. The precedence is the great oil shock of the 70’s, during which Arab nations halted oil supply to the world markets in order to put pressure on the West. The oil shock of the 1970s prompted America to invest heavily in oil production and extraction, but the oil shock that the world is facing now has prompted some advanced nations, especially in Europe, to diversify energy sources.

Because European and East Asian countries lack the necessary resources for oil and gas production and extraction, investment in clean and renewable energies has been considered as the best alternative. Of course, there are other reasons, among them the increasing pressure by environmental movements and the commitment of various nations to reduce their carbon dioxide and other environmental pollutant footprints. However, data from the McKinsey Research Center shows that the world is still a long way from the adoption of renewable energy (RE).

Of course, this resource is an alternative to nuclear energy (NE), but RE may lose status because of its own nature of environmental hazards. With the occurrence of earthquakes & tsunami in Japan and related consequences, the future of NE is also highly uncertain. European countries such as Germany and France have planned to reduce their nuclear energy footprint in their energy portfolios, but the direct relationship between the advancement of nuclear energy and the energy security index has encouraged other governments to develop NE. Despite the plans announced by the EU member states to reduce nuclear energy utilization, a growing global trend is predicted in the coming years, with China and India making a significant contribution to NE growth.

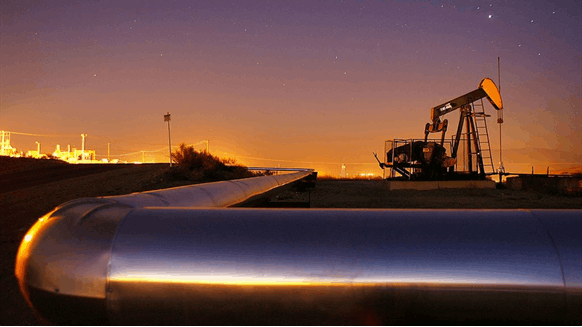

The analysis of trends in the energy market predict that the peak of global oil demand will occur between 2024 and 2027, and in the early 2030s, the volume of oil demand in energy markets will gradually decrease. But in the case of natural gas, the period of high demand will last slightly longer. Statistics indicate that the growing trend of demand for natural gas will have a continuous growth trend until the middle of the next decade (i.e. 2035) growing between 10 to 20 percent compared to its current level. The main challenge to exporting natural gas is ensuring security and supply stability, which may be resolved with a threefold increase in the number of liquefaction station installations. According to McKinsey, the world’s major oil and gas extraction conglomerates, which are largely located in the Middle East and Russia, can extract oil and gas at their current rate for the next 40 to 60 years or even longer, if they use their excess capacity. Therefore, for the next decade at least, the undisputed domination of oil and gas will be maintained in the world markets. The value placed on fossil fuels will be reduced after this period, if all goes according to plan and forecasts are true.