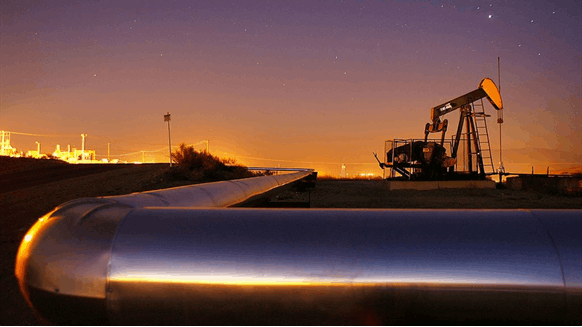

In this week’s preview of what to watch in oil and gas markets, Rigzone’s regular energy prognosticators turn their attention to weather patterns, implied U.S. supply trends, potential government action, and more. Read on below to find out the specifics.

Rigzone: What developments/trends will you be on the lookout for this week?

Tom Seng, Director – School of Energy Economics, Policy, and Commerce, University of Tulsa’s Collins College of Business: As October winds down, we will be looking for the first major cold fronts that will test the below-normal levels of both natural gas and heating oil inventories. Will the LNG backlog in Europe impact U.S. Gulf Coast natural gas prices? And could that actually lead to some larger storage builds that will increase our readiness for winter? New England, notorious for blocking natural gas pipeline projects both new and expanded, may be in serious trouble should a colder-than-normal winter hit that area. The region has been known to burn fuel oil and import LNG to supplement their needs in the past. Fuel oil will be harder to come by and importing LNG from Russia is out of the question now. If the U.S. finds itself short of heating oil, will the government take action to suspend refined product exports?

Vikas Dwivedi, Global Oil and Gas Strategist for Macquarie Group: We remain attuned to implied U.S. supply trends in weekly DOE crude balances given particularly large balancing items recently. While weekly DOE balances can be noisy, they can offer a more real-time window into U.S. crude fundamentals (and potential production growth) than heavily lagged monthly data. We will continue to watch how sweet-grade physical premiums trend as refineries around the world exit fall turnarounds and Chinese refineries increase their crude purchases for higher refining runs later this year and into 2023.

Source: rigzone